www.chase.com

www.chase.com

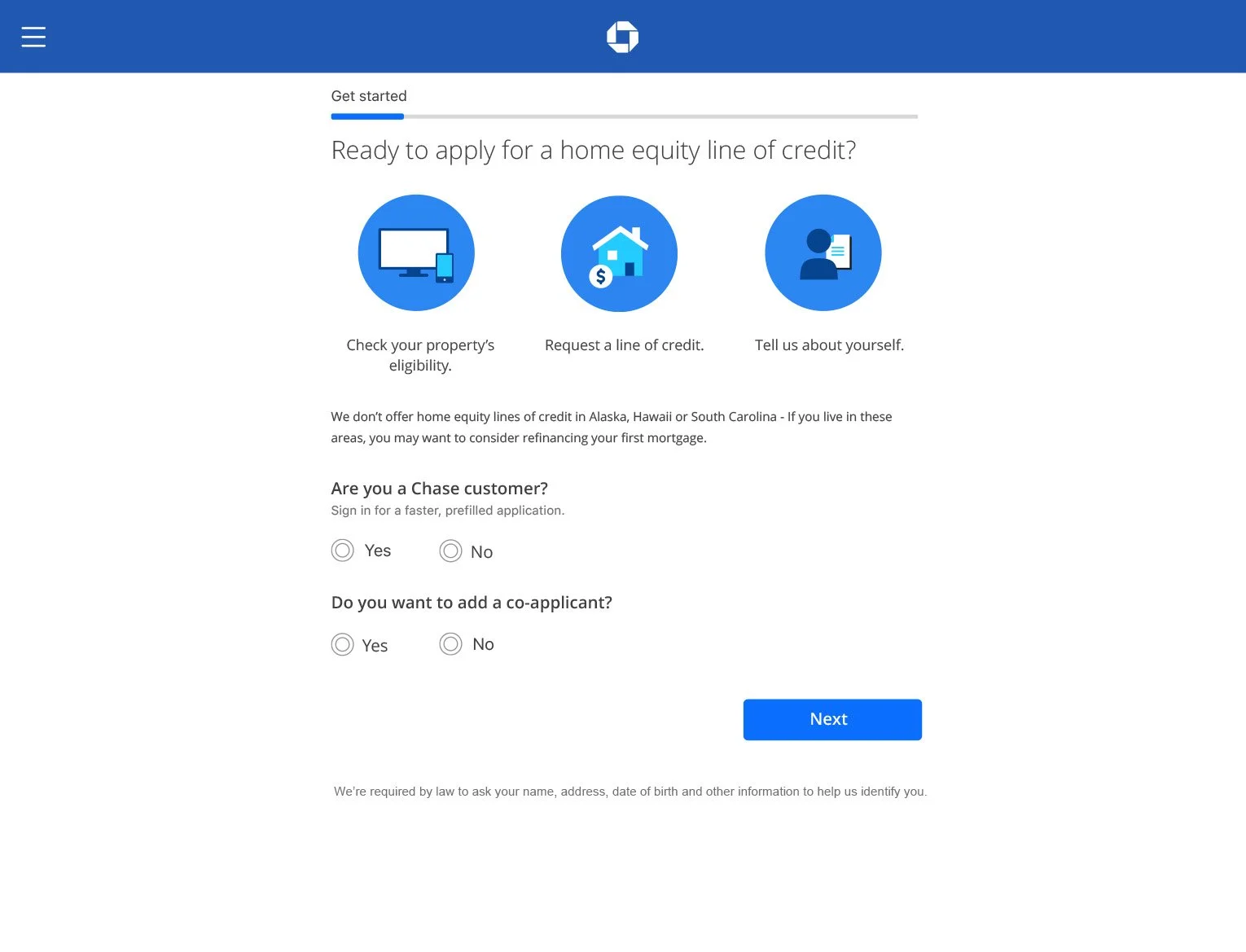

Home Equity Line of Credit - HELOC

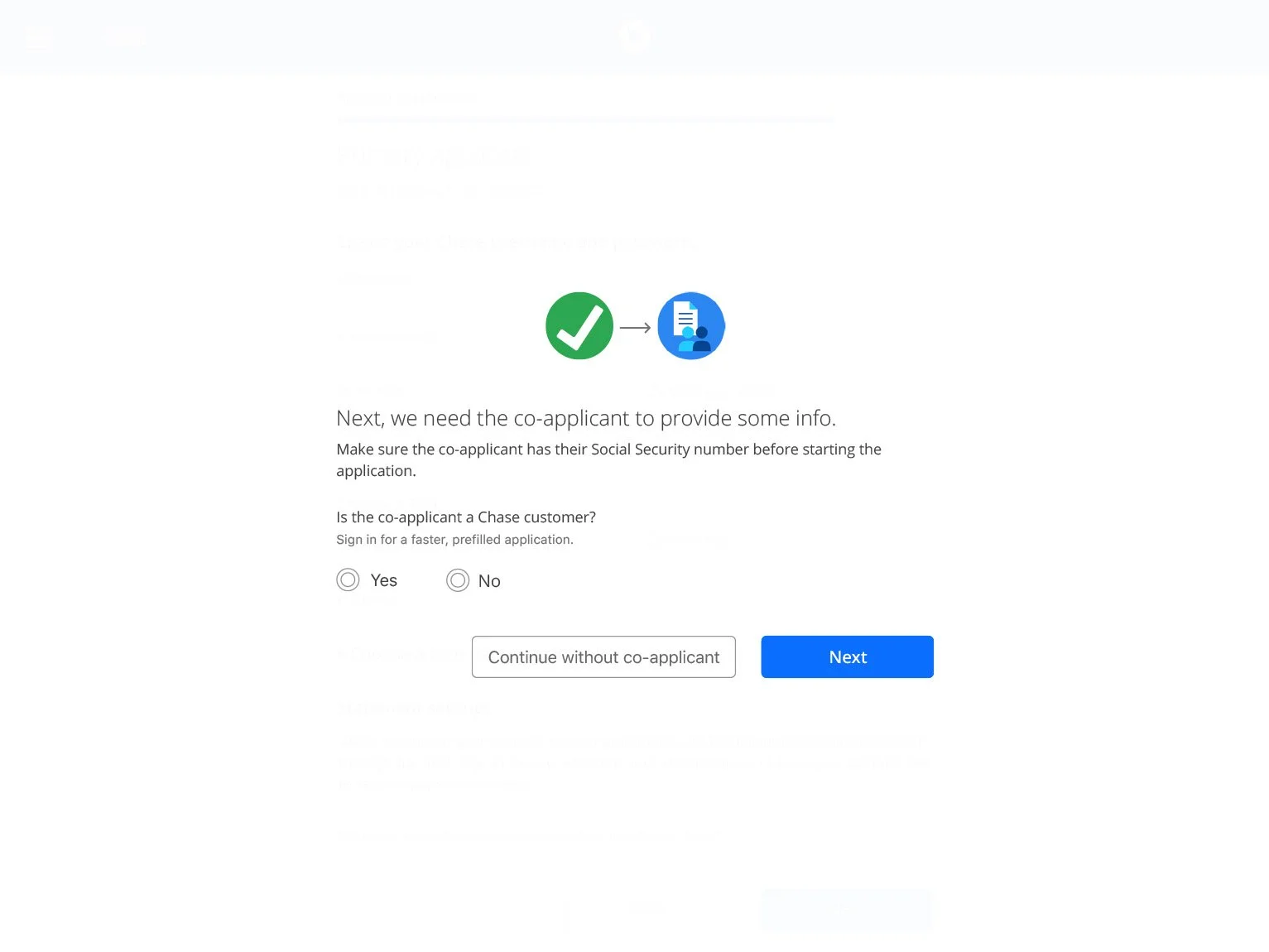

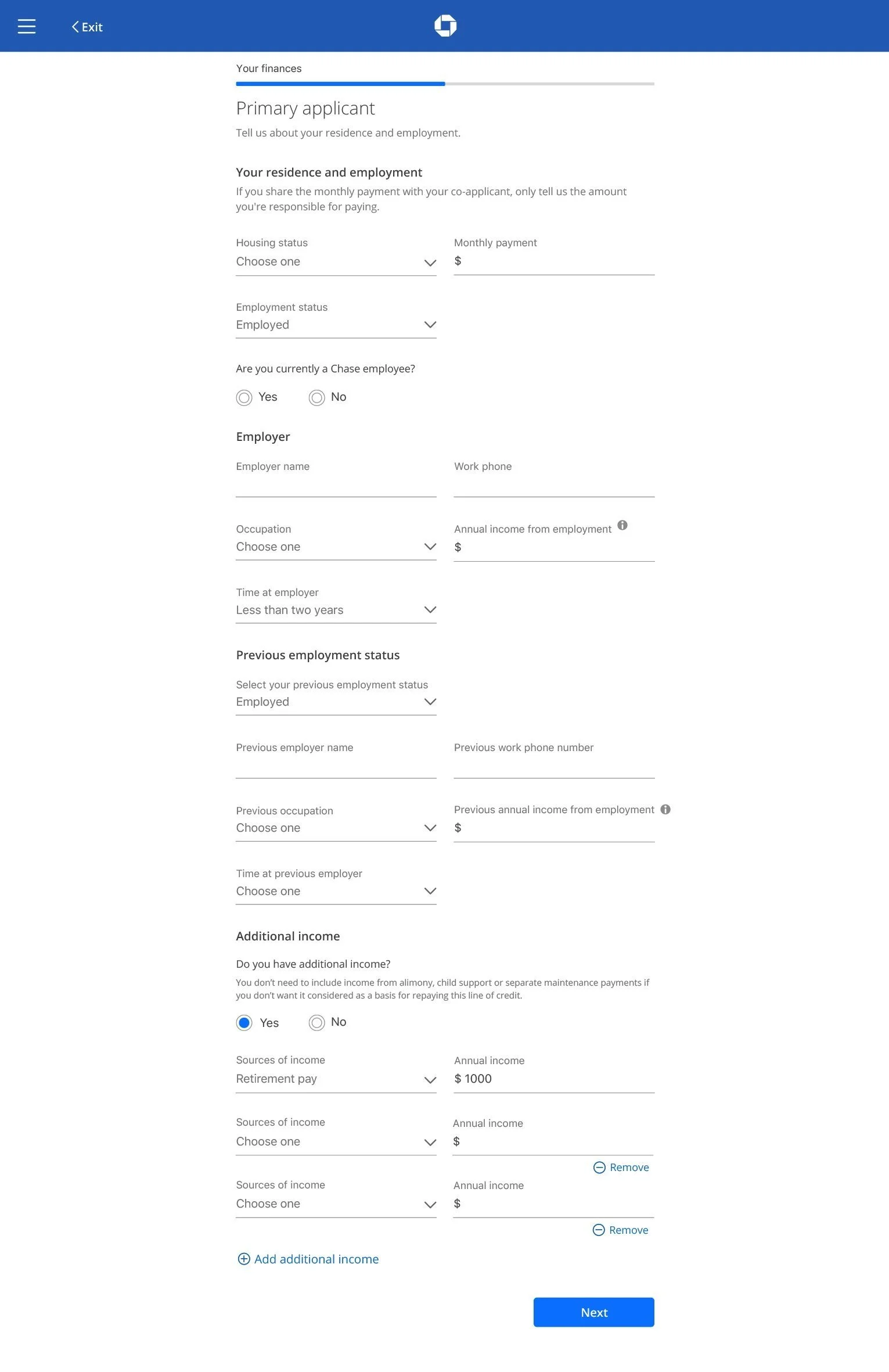

This project represents a significant innovation in home lending from Chase, integrating the capabilities of Roostify, a sophisticated mortgage application platform. The primary focus of this initiative is to streamline the process for customers to manage their online credentials effectively, ensuring a seamless entry into the mortgage application process. A critical aspect of this project is the efficient capture of essential customer information, laying the groundwork for a secure and streamlined loan application experience.

The user experience is at the forefront of this initiative. To this end, Chase has developed an interface that is not only mobile-optimized but also compliant with the Americans with Disabilities Act (ADA), ensuring accessibility for all users. This interface is specifically designed to cater to the needs of new-to-bank prospects, enabling them to set up their chase.com profile quickly and easily, thus facilitating a smooth start to their home lending journey. Through these innovations, "My Home" embodies Chase's dedication to providing a customer-centric, accessible, and digitally empowered home lending process.

Project Requirements:

Integration with Roostify: Ensure seamless integration of Roostify's mortgage application capabilities with Chase's digital platforms.

Customer Authentication: Develop a secure and user-friendly system for customer authentication to manage online credentials effectively.

Data Capture and Security: Implement a robust system for capturing essential customer information while ensuring data security and privacy compliance.

User Onboarding Process: Design an intuitive onboarding process for new-to-bank customers, facilitating the creation of chase.com profiles.

Cross-Platform Compatibility: Ensure the application is compatible across various digital platforms, including web and mobile.

Compliance and Legal Requirements: Adhere to all relevant legal standards, including banking regulations and data protection laws.

Scalability and Performance: Ensure the system is scalable to handle increasing user numbers and maintain high performance under varying loads.

Customer Support Integration: Incorporate efficient customer support mechanisms within the application, including FAQs, chatbots, and contact information.

Design Requirements:

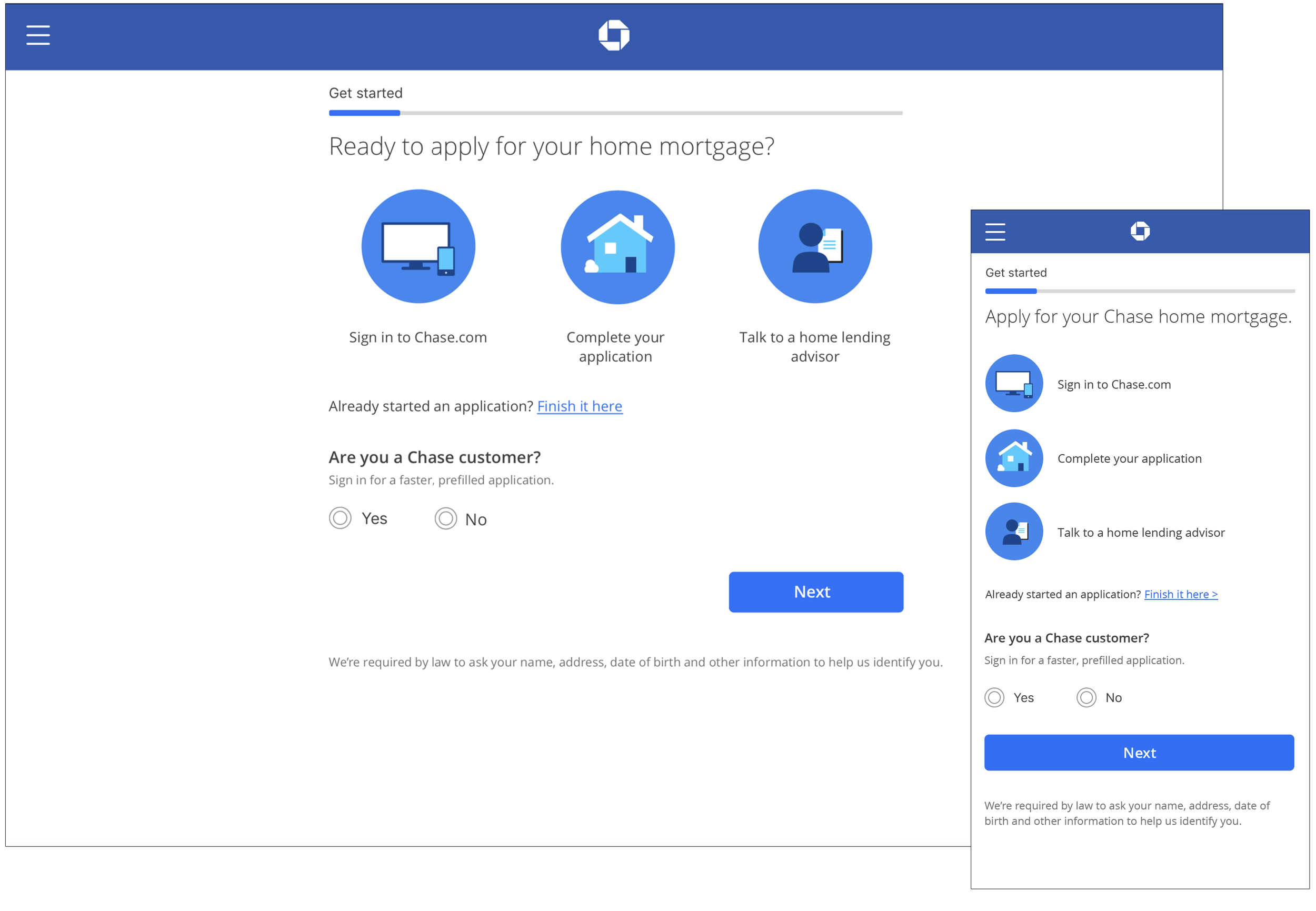

Mobile Optimization: Design the interface to be fully optimized for mobile devices, ensuring a seamless experience on smartphones and tablets.

ADA Compliance: The interface should be compliant with the Americans with Disabilities Act (ADA), ensuring accessibility for users with disabilities.

User Experience (UX) Design: Focus on creating an intuitive, user-friendly, and engaging UX design to enhance customer satisfaction and ease of use.

Visual Aesthetics: Employ a visually appealing design consistent with Chase's branding and aesthetic standards.

Interactive Elements: Incorporate interactive elements like drop-down menus, sliders, and progress indicators to enhance user engagement.

Responsive Design: Ensure the design is responsive and adjusts smoothly to different screen sizes and orientations.

Feedback Mechanisms: Include user feedback mechanisms to gather insights for continuous improvement of the interface and user experience.

Multilingual Support: Consider providing multilingual support to cater to a diverse customer base.

Testing and Iteration: Establish a rigorous testing protocol for the interface, including usability testing, and plan for iterative design enhancements based on user feedback.

Application Entry Point

My Roles:

Design Project Lead: Steered the design vision, ensuring aesthetics and functionality aligned with project objectives.

UI/UX Workshop Facilitator: Led workshops to gather input, refine design ideas, and facilitate understanding and consensus among stakeholders or within the design team.

Research Lead: Conducted and analyzed market and user research to inform data-driven design decisions.

User Research Coordinator: Organized and coordinated user research efforts, including recruiting participants, scheduling sessions, and facilitating interviews.

Prototyping & Testing Oversight: Spearheaded the prototyping and testing phases, validating design efficacy and ensuring product reliability before deployment.

Project Management: Managed project timelines, resources, and stakeholders, ensuring systematic progress and adherence to predefined benchmarks.

Target Users:

First-Time Homebuyers: Individuals or families navigating the home buying process for the first time, seeking guidance and a simple interface.

Existing Homeowners Considering Refinancing: Homeowners looking to refinance, needing tools for comparison and clear refinancing information.

Real Estate Investors: Property investors require efficient processing and detailed investment information.

Tech-Savvy Millennial and Gen Z Buyers: Young adults familiar with digital technology, preferring a digital-first and mobile-optimized experience.

Customers with Disabilities (ADA Compliance): Users needing accessible digital interfaces due to disabilities, requiring ADA-compliant features.

Non-English Speaking or Multilingual Customers: Individuals more comfortable in languages other than English, needing multilingual support.

Busy Professionals: Working professionals seeking a fast, efficient mortgage process that accommodates their time constraints.

Elderly or Retired Individuals: Older adults, possibly downsizing or buying retirement homes, needing straightforward navigation and clear information.

Low to Moderate-Income Families: Families seeking affordable housing options, interested in special loan programs and financial assistance.

New-to-Bank Prospects: Individuals new to Chase, looking for easy onboarding and clear information about Chase's services.

Design Process

Project Collaboration Process

Mobile Optimization - Responsive Design